CORPORATE GOVERNANCE

REPORT

PRINCIPLE SIX – REPORTING WITH INTEGRITY

FINANCIAL

SUSTAINABILITY

The COVID-19 has offered an unprecedented opportunity for companies to move towards the integration of environmental, social and governance (“ESG”) in their management system. There is a global increase in awareness in regards to ESG and operational resilience amongst the private sector community. We, at AfrAsia Bank, have also taken this commitment to work on a 2030 Sustainability Strategy to contribute to a net zero carbon economy. Looking back on the financial year 2020-2021, which has been disrupted by this crisis, we have to admit that many of the departmental projects had to be either postponed or adapted to the ‘new’ normal. For the third consecutive year, we have provided a separate sustainability report which details the Bank’s performance in each of its 4 pillars based on the Global Reporting Initiative (“GRI”) standards.

AfrAsia Bank’s 2021 sustainability strategy:

Furthermore, for the third-year consecutive, we are a proud member of the GRI community and participate regularly in dialogues and webinars to advance sustainability reporting standards.

The year 2021 has also brought new changes to the Sustainability and CSR department with a new Head joining the team. A new sustainability strategy is currently being developed and will be announced in the beginning of next year.

-

WORKPLACE

RESPONSIBILITY - MARKETPLACE RESPONSIBILITY

-

ENVIRONMENTAL

RESPONSIBILITY -

SOCIAL

RESPONSIBILITY

-

WORKPLACE

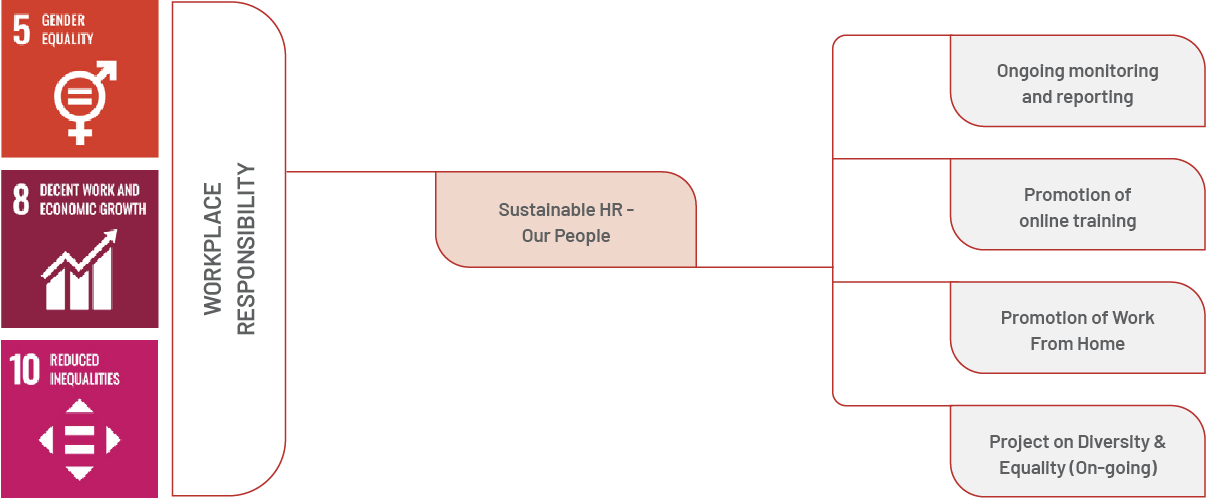

RESPONSIBILITYSeveral projects are currently in progress under the aegis of the Human Resources (“HR”) department. With the COVID pandemic impacting our operations and day to day work, our main concerns were job retention and on-going training of our staff.

Overview of HR projects:

FY 17-18 FY 18-19 FY 19-20 FY 20-21 Total Headcount 368 402 413 415 Average Hours Of Training 18 39 19.5 10.8 Average Hours Of Training (Male) 19 46 18.36 10.7 Average Hours Of Training (Female) 18 32 20.7 11 Turnover Rate (Full Time Employees) 9.48% 8.97% 11.1% 6.7% Snapshot of key performance indicators for workplace responsibility throughout the last 4 years

We strive to create a safe, inclusive and discrimination-free environment for all our staff through the various projects under the HR department and through the Health & Safety Committee.

-

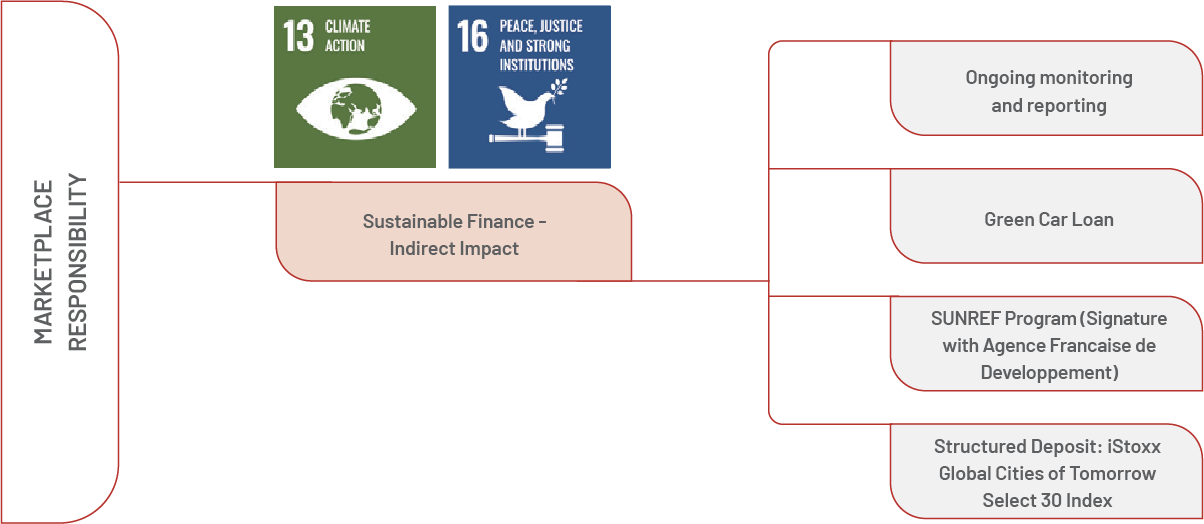

MARKETPLACE RESPONSIBILITY

As a Bank, one of our major impact is through our financing. We have been steadily developing this pillar to provide our clients with sustainable financial products across the different business lines.

Overview of Sustainable Financing:

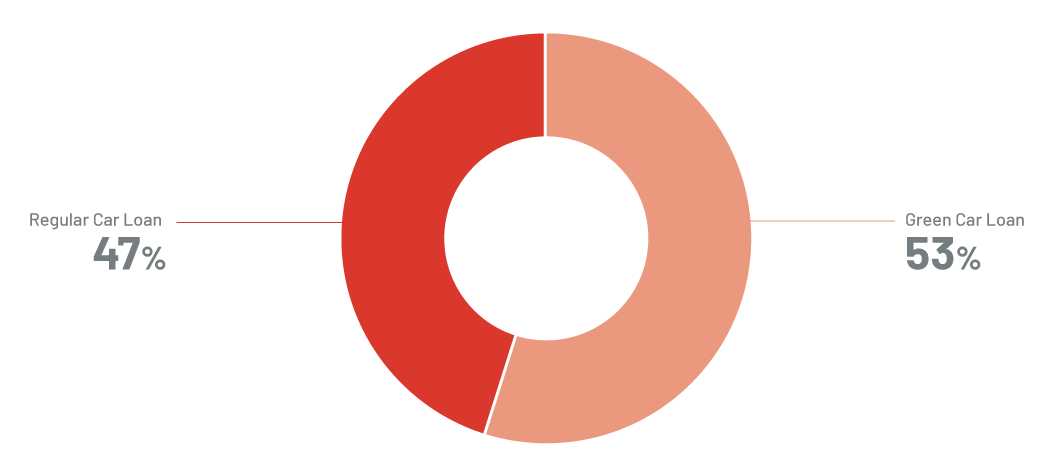

The financial year 2020-2021 has been critical for the development of sustainable financing at ABL. With the Bank joining the SUNREF program and the ongoing implementation of Environmental and Social Management System (“ESMS”), we are looking to transform our entire credit portfolio. The treasury team has also started offering structured deposits based on sustainable criteria.

Snapshot of Green Car Loan Performance from July 2020 to June 2021:

As part of our Marketplace Responsibility Strategy, we also strictly adhere to all legal and statutory requirements (including in regards to prevention of money laundering and financing of terrorism activities) and protect our client’s data through stringent measures in place to prevent any breaches.

-

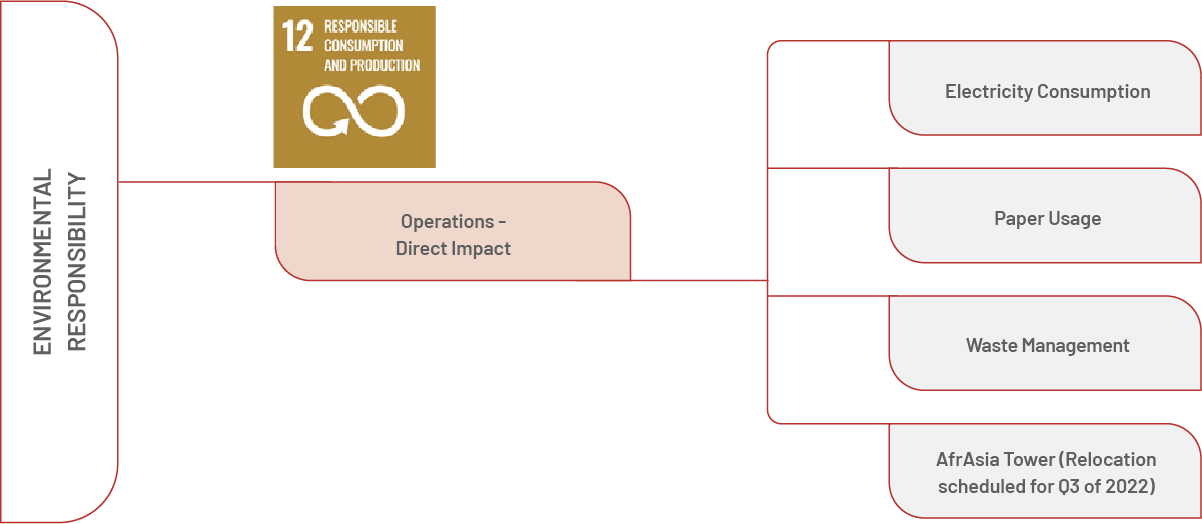

ENVIRONMENTAL

RESPONSIBILITYAside from our credit portfolio, we are also looking into the management of our direct impact. With relocation of our premises scheduled for Q3 2022 to the AfrAsia Tower in the Tribeca Central Smart City, the Bank is aiming to provide an innovative future workspace as well as a greater operational to its employees. The AfrAsia Tower will be an environmentally-advanced, energyefficient and sustainable workplace, with a LEED certification based on international sustainability standards. Until then, we will continue to monitor our electricity consumption and paper usage.

Overview of HR projects:

Snapshot of key performance indicators for workplace responsibility throughout the last 4 years

FY 17-18 FY 18-19 FY 19-20 FY 20-21 Electricity Consumption At Ebene Office (KWH) N/A 554,776 548,867 496,114 Paper Usage (Reams) 4,432 4,281 3,865 2,692 Quantity Of E-Waste Recycled (KG) N/A 286 58 226 -

SOCIAL

RESPONSIBILITYOverview of Social Responsibility at AfrAsia Bank:

ABL’s social strategy is mainly managed through the AfrAsia Foundation, which is governed by a council, who is responsible for management of the funds. The accounts of the Foundation are also audited annually by an external auditor.

Overview of Projects by AfrAsia Foundation:Education

AfrAsia School

- Emergency Aid Support

Programme (COVID-19) - Sponsor an AfrAsia Kid

- Wish Tree

AfrAsia Golf Academy

(on hold due to the pandemic)Health

Cancer Awareness

- Support to Link to

Life Projects

Ripple Project

Bring back a Smile Initiative

(Distribution of special masks

to hearing impared children)Environment

The Wakashio Initiatives

- Phase 1 - Immediate actions and support

- Phase 2 - Donation to Mahebourg Espoir beneficiaries

- Phase 3 - In Progress

- Emergency Aid Support