CORPORATE GOVERNANCE

REPORT

PRINCIPLE ONE – GOVERNANCE STRUCTURE

OUR GOVERNANCE FRAMEWORK AND

ACCOUNTABILITIES

ABL, a public company incorporated on the 12th of January 2007, holds a banking licence which was issued on the 29th of August 2007. Its core banking and transactional capabilities are in Mauritius along with a representative office in South Africa. It is a Public Interest Entity (“PIE”) as per the Financial Reporting Act 2004 and adheres to the requirements of the relevant rules, regulations and legislations.

The Bank operates under the aegis of a unitary Board, collectively geared in guiding and directing the organisation to take the necessary steps to adhere, to the best of the Board’s knowledge, to all legal and regulatory requirements including:

- The eight principles issued by the National Committee on Corporate Governance in its “National Code of Corporate Governance for Mauritius (2016)” (the “Code”);

- The Banking Act 2004 (amended 12 August 2021);

- The “Guidelines on Corporate Governance 2001” (revised October 2017) issued by BOM; and

- The provisions of The Companies Act 2001 of Mauritius.

ABL has in place a Conduct and Ethics Policy and in line with same, it is committed to employing the right people and to promote a culture of mutual respect and ethical behaviour. Employees and Directors are expected to treat each other with consideration and respect and are not permitted to engage in conduct which is hostile or offensive to another person. The Bank promotes transparency and all staff and Directors are made aware and accountable of their responsibilities.

A copy of the Bank’s Conduct and Ethics Policy is available on its website as follows:

(https://www.afrasiabank.com/media/3222/conduct-and-ethics-policy-staff.pdf).

OUR GROUP STRUCTURE AS AT 30 JUNE 2021

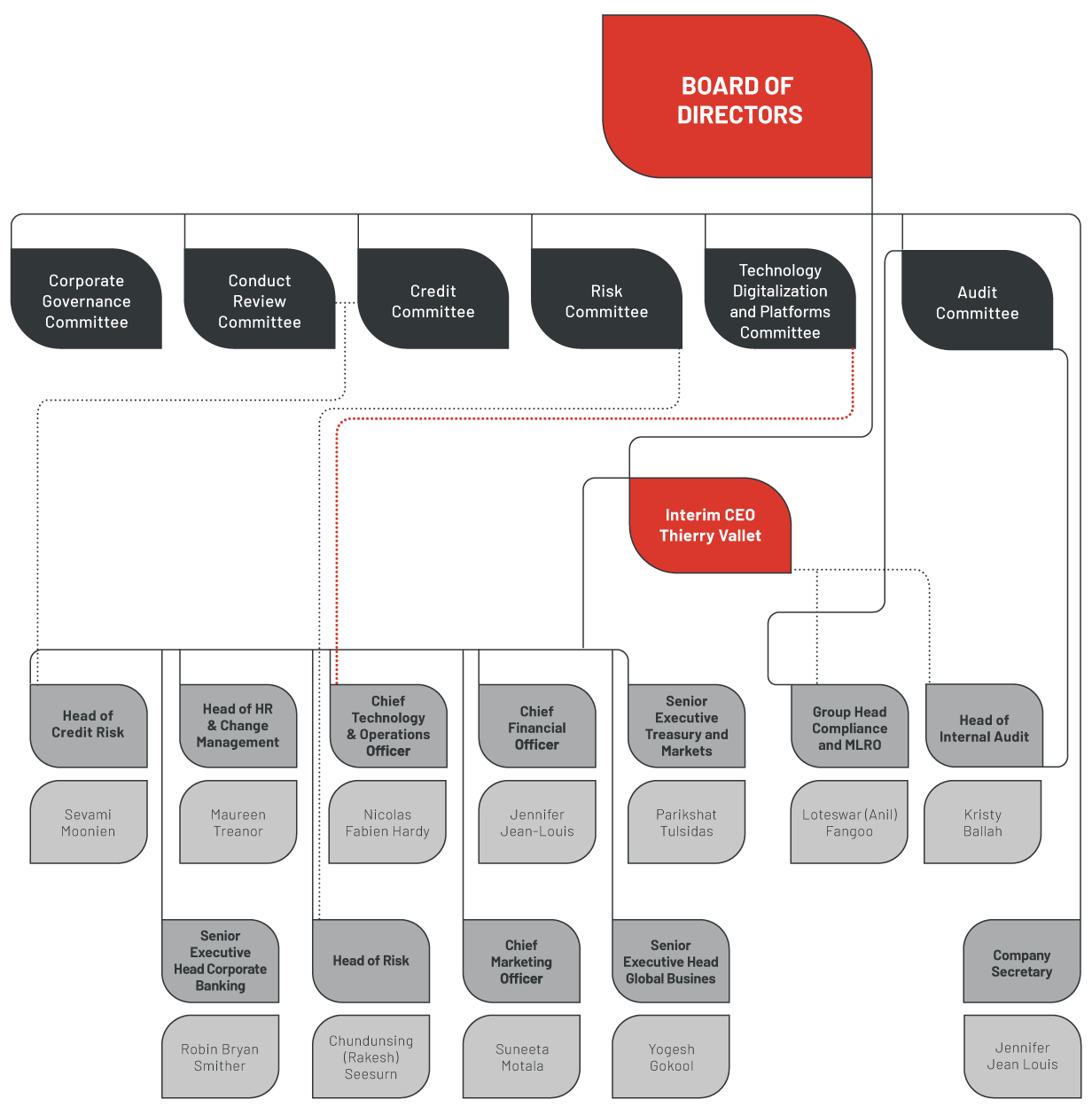

OUR GOVERNANCE STRUCTURE AS AT 30 JUNE 2021

Note: The Governance Structure above did not include the Corporate Governance Committee as none of Senior Management report to the latter.

*Effective date of resignation is 31 August 2021.

KEY GOVERNANCE POSITIONS

The Bank sets the tone for its employees and Directors to uphold the highest standards of integrity, transparence and probity. The Terms of Reference, which the Board reviews and approves as and when required, defines all key governance positions within the Bank and their corresponding accountabilities which are critical drivers of strategic performance and for optimised adherence to proper governance. A clear line of demarcation is drawn between the roles and responsibilities of the Chairperson and the Chief Executive Officer (CEO) to impede any unfettered powers; these are listed below:

Chairperson of the Board

The duties of the Chairperson include:

- To preside meetings of Directors and to ensure the smooth functioning of the Board in the interests of good governance. He/she will usually also preside over the Bank’s meetings of shareholders;

- To provide general leadership to the Board and encourage active participation of each Director in discussions and Board matters;

- To participate in the selection of Board members to ensure an appropriate mix of competencies, experience, skills and independence on the Board;

- To oversee a formal succession plan for the Board, the CEO and the Senior Management;

- To make sure that monitoring and evaluation of the Board and the Directors’ appraisal are carried out;

- To ensure that all relevant information and facts are given to the Board so as to enable it to take informed decisions;

- To maintain sound relations with the Bank’s shareholders and ensure that the principles of effective communication and pertinent disclosures are followed; and

- To submit to the Bank, for each financial year, a compliance statement certifying that the Bank has complied with the provisions of law and regulations and guidelines issued by the Bank.

Chief Executive Officer

The main functions of the CEO are:

- To develop and recommend to the Board a long-term vision and strategy for the Bank that will generate satisfactory levels of shareholder value and positive, reciprocal relations with the relevant stakeholders;

- To devise and recommend to the Board annual business plans and budgets that support the Bank’s long-term strategy. The CEO must ensure that a proper assessment of the risks under a variety of possible or likely scenarios is undertaken and presented to the Board;

- To strive consistently to achieve the Bank’s financial and operating goals and objects and ensure the proper management and monitoring of the daily business of the Bank; and

- To be the chief spokesperson for the Bank in relation to all operational and day-to-day matters. The CEO and the other key officers of the Bank must attend meetings of the shareholders and be ready to present material operational developments to the meeting.

SENIOR MANAGEMENT TEAM PROFILE

-

THIERRY VALLET

Interim CEOMaster of Business Administration - International Finance

HEC School of Management, ParisDate joined AfrAsia: 20-Aug-07

Engineer by trade, financial engineer by profession, Thierry is a seasoned banker bringing more than 20 years of expertise and insights to the Banking and Finance industry. As Founder Executive of AfrAsia Bank and heading the Strategic Development since inception, Thierry has contributed to the growth of AfrAsia Bank multifariously. From establishing the Bank’s rocksolid foundation, pioneering Private Banking in Mauritius, being a key pillar in the inception and success of the AfrAsia Bank Mauritius Open, to positioning the Bank and the Mauritius jurisdiction on international platforms, Thierry has played a key role in AfrAsia’s Bank Different journey – attested by the multiple accolades earned by reputable international bodies. Over the past 14 years, Thierry has contributed to the achievement of key milestones in different capacities: he was promoted to General Manager in 2012; he served as Director of AfrAsia Group subsidiaries; and presently, Thierry is the Interim CEO of the Bank.

-

YOGESH GOKOOL

Senior Executive – Head Global BusinessSociety of Trust and Estate Practitioners (STEP)

Mauritius Institute of Directors (MIoD)

International Tax Planning Association (ITPA)Postgraduate qualification

The Mechanics of Private Equity

Middlesex University, LondonDate joined AfrAsia: 03-Jul-08

Over 25 years of experience in financial management gained whilst working for International Financial Services Ltd(now Sanne Mauritius), a leading local offshore management company, overseeing a portfolio of over 100 clients including mutual funds and private equity funds. Yogesh also worked for Deutsche Bank (Mauritius) where he headed the fiduciary services division. He sits on the Board of STEP Mauritius, which promotes private clients work and liaises with the Government of Mauritius on current issues and the implementation of fiduciary legislation. Yogesh currently heads up the global business side of the Bank.

-

NICOLAS FABIEN HARDY

Chief Technology & Operations OfficerMaster of Business Administration

University of Cape TownB.Sc. Mathematics

University of Natal, South AfricaDate joined AfrAsia: 03-Jun-19

Nicolas brings over 18 years of experience within various senior positions in banking. Treasurer by trade, he has cumulated many management responsibilities including credit, ALCO, private banking, FI relationship and operational risk whilst directing the strategic operations and technological development, encompassing the online, digital and currency cards. Nicolas’s background includes serving in other leadership roles at NatWest Markets, Robert Fleming & Co, Rogers Group, Tomfin Asset Management and Digi-Strat. Nicolas currently oversees the operational and technological areas of the Bank.

-

SEVAMI MOONIEN

Head of Credit RiskB.Sc. (Hons) in Management

University of MauritiusDate joined AfrAsia: 28-Oct-13

Sevami has an extensive career in the banking sector counting more than 20 years of experience. Prior to joining AfrAsia, Sevami held several senior positions within the field of credit risk at Standard Bank (Mauritius) Limited and Absa Bank (Mauritius) Limited. During her career, she has developed a broad knowledge of both local and international markets. She currently heads the credit risk department, providing leadership and guidance in all matters relating to credit risk management, credit approvals, monitoring and controlling the credit portfolio.

-

JENNIFER JEAN-LOUIS

Chief Financial Officer & Company SecretaryFellow Chartered Accountant (FCA)

Institute of Chartered Accountants in England and Wales

Chartered Tax Advisor in England and WalesMauritius Institute of Directors (MIoD)

Date of first appointment as Director: 30-Jul-07

A Chartered Accountant with 20 years plus of experience, having practised locally and internationally in auditing, taxation and advisory, Jennifer returned to Mauritius in 2007 and joined AfrAsia Bank at its very inception stage to build the foundation of the financial framework and structure of the Bank. Apart from the responsibilities of overseeing the accounting team and in charge of the financial affairs of the Bank, Jennifer has participated in numerous strategic initiatives, including capital raising, mergers and acquisitions (M&A) and International Financial Reporting Standards (IFRS) transitions. During the year, Jennifer took the additional responsibility as Company Secretary and cumulates this role alongside her position as CFO of the Bank and its subsidiary.

-

SUNEETA MOTALA

Chief Marketing OfficerPre-associateship

Chartered Institute of BankersM.Sc. in Marketing

Salford University, UKInternational Certificate for Financial Advisors

Chartered Insurance InstituteGeneral Management Certificate

ESSEC Business School, FranceDate joined AfrAsia: 01-Jul-07

Suneeta is a seasoned banker with more than 25 years of experience in the financial services industry. She started her career at HSBC in branch operations and has risen through the ranks of sales, credit, risk management and marketing along her journey. An individual who thrives on turning complexities into opportunities, Suneeta joined AfrAsia in 2007 as Head of Marketing & Public Relations and built the brand from scratch through breakthrough strategies, contributing towards positioning AfrAsia amongst the five systemically important Mauritian Banks. A firm believer in female leadership, Suneeta is the first African member of the CMO Club – the world’s most innovative and engaged member-based community of Chief Marketing Officers.

-

CHUNDUNSING (RAKESH) SEESURN

Head of RiskAssociation of Chartered Certified Accountants (ACCA)

Chartered Institute for Securities & Investment (United Kingdom(UK))

Mauritius Institute of Directors (MIoD)

The Institute of Risk Management South Africa (IRMSA)Date joined AfrAsia: 04-Sep-16

Rakesh was appointed Head of Risk in October 2018. He was previously Business Manager reporting to the Senior Executive – Corporate Banking and to the CEO. He currently oversees the Market Risk, Asset and Liability Management, Recovery, Anti-Money Laundering (AML), Operational Risk and IFRS 9 implementation divisions. Prior to joining AfrAsia, Rakesh accumulated extensive experience through various senior roles driving change across the Audit & Finance divisions with Deloitte & Touche Qatar, Deutsche Bank and Standard Bank. He brings over 20 years of onshore and offshore expertise in key areas such as risk appetite, budgeting, strategic planning and other fundamental projects.

-

ROBIN BRYAN SMITHER

Senior Executive – Head Corporate BankingMaster of Business Administration

University of Witwatersrand (WITS) South AfricaPost Graduate Diploma in Business Management

University of Witwatersrand (WITS) South AfricaDegree in Social Science (PPE)

University of Cape TownDate joined AfrAsia: 07-Jan-13

Robin has over 20 years’ experience in corporate and investment banking with an extensive knowledge in global markets, investment banking and lending products. Robin was with Standard Bank for more than 11 years, spent 3 years in Mauritius as Head of Corporate Banking, followed by some time in South Africa as a senior banker to Standard Bank’s large global multinational clients where he developed an extensive knowledge of Africa related banking and business. Robin currently heads up the domestic and international corporate banking activities for the Bank.

-

MAUREEN TREANOR

Head of Human Resources and Change ManagementMaster of Business Administration

Edinburgh Business School, UKQualifications in Human Resources

ABE UKProject Management

University of MauritiusMauritius Institute of Directors (MIoD)

Date joined AfrAsia: 01-Jun-2010

Maureen started her career with Barclays Bank (UK) approximately 25 years ago. She joined AfrAsia as Head of Human Resources and Change Management in 2010; she has local and international experience.

-

PARIKSHAT (PARIK) TULSIDAS

Senior Executive – Treasury and MarketsBachelor of Arts in Marketing and HR

Middlesex University LondonACI Dealing Certificate

ACIDate joined AfrAsia: 21-Jan-13

Effective date of resignation: 31-Aug-21

Parik, a Mauritian national, has more than 20 years’ experience in corporate & investment banking and treasury. He joined AfrAsia Bank Limited from Standard Bank where he held the position of General Manager, Global Markets Advisory (China); prior to his move to Beijing, he held the post of Head of Sales - Global Markets (Mauritius) for approximately 5 years.