MANAGEMENT DISCUSSION

AND ANALYSIS

- Home

- MANAGEMENT DISCUSSION AND ANALYSIS

FOREWORD

This financial year was undoubtedly an inflection point in many dimensions; The conspicuous acceleration of digital consumption of goods and services, dramatic transformation in work habits, challenges to the corporate risk appetite, and the management of multiple headwinds among others. The Bank had to up the ante against the ebb and flow of financial markets and capitalised on its nimbleness to gear volatilities in its favour. However, on a day-to–day basis, one key driving force remains at the heart of the Bank and its operations and that is client satisfaction, sustainable client satisfaction.

BUSINESS HIGHLIGHTS

TOTAL ASSETS

(MUR’BN)

2021: MUR 190.1bn

2020: MUR 160.5bn

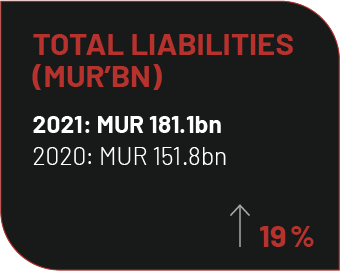

TOTAL LIABILITIES

(MUR’BN)

2021: MUR 181.1bn

2020: MUR 151.8bn

TOTAL EQUITY

(MUR’BN)

2021: MUR 9.0bn

2020: MUR 8.6bn

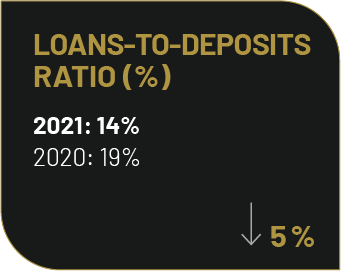

LOAN-TO-DEPOSITS

(MUR’BN)

2021: 14%

2020: 19%

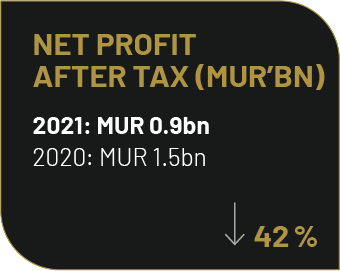

NET PROFIT AFTER TAX

(MUR’BN)

2021: MUR 0.9bn

2020: MUR 1.5bn

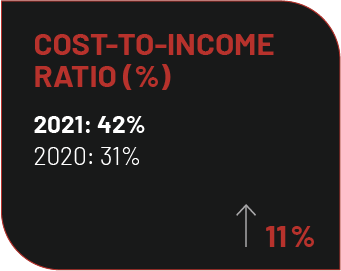

COST-TO-INCOME

RATIO (%)

2021: 42%

2020: 31%

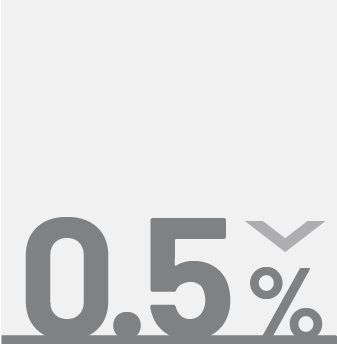

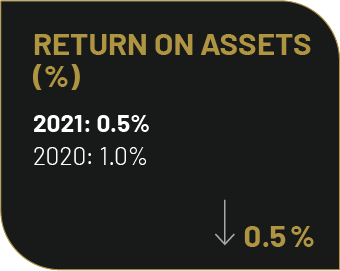

RETURN ON ASSETS

(%)

2021: 0.5%

2020: 1.0%

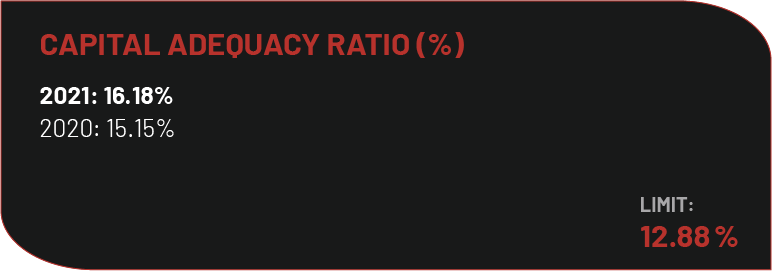

CAPITAL ADEQUACY RATIO

(MUR’BN)

2021: 16.18%

2020: 15.15%

BUSINESS SEGMENTS REVIEW

ACHIEVEMENTS IN THE FINANCIAL YEAR (“FY”) 21

Major Business Segment’s Achievements

During the financial year, the Global Business Desk remained the main cross-selling hub for the various product houses at the Bank be it in terms of liabilities/ assets/ assets under custody/ assets under management/ transactional and FX income/ others. We managed to grow our deposits book for non-resident clients by 22%, assets under custody by 21% and Overseas transfers by 14%, as reflected in the charts below:

The Challenges and the Future

Looking ahead, the Global Business Desk remains well positioned to benefit from the improved global economic outlook amidst progress of the vaccination rollout and gradual relaxation of lockdown restrictions in key markets. In addition, we finally found some light at the end of the tunnel with the reopening of the Mauritian economy in October 2021 and the high possibility of the jurisdiction being removed from the EU blacklist sooner. Gradually, the Global Business sector should pick up on the back of increased investment and trading activities globally. Going forward, we will resume overseas travelling, hit the road for expanding our network of introducers and increase the portfolio of direct clients.

OUR CORE PILLARS

- Our Customers and Intermediaries.

- Cross Selling Hub for the Bank.

- External Asset Management Desk.

Major Business Segment’s Achievements

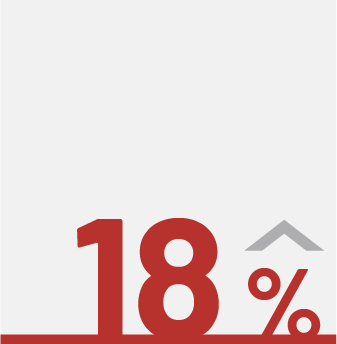

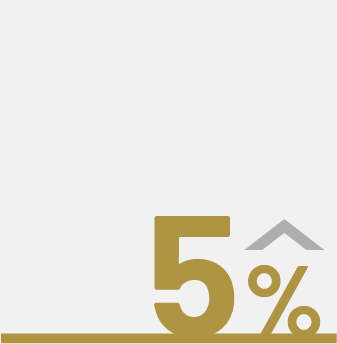

Consumer Banking had a strong performance in FY21 despite the challenges and threats caused to the business. Mauritius was put on the EU blacklist and the severe dropin business activities related to the global COVID-19 pandemic. Thanks to the team’s resilience and their hard work, the liabilities book grew by above MUR 1.1bn (+5%) while the assets book increased by more than MUR 560m (+18%).

This accomplishment was made possible based on a few factors:

- Maintaining proximity during the lockdown with ABL’s most valuable clients through regular phone calls, WhatsApp messages and virtual meetings.

- Promoting our AfrAsia Loyalty Package proposition as much as possible to senior employees of IBL Group of Companies & those of large COVID-19 resilient corporates banking with ABL.

- Creating a synergy within the bank to pro-actively cross-sell to professionals, managers and executives (residents, non-residents & expatriates) within ABL existing customer base.

Our Strategy and Proposition

For the new financial year 2021-2022, and taking into consideration the persisting effects of the global pandemic, the strategy will target the following segments:

- High-Net-Worth Individuals (“HNWI”);

- Small and medium-sized enterprises;

- Trusts;

- Foundations; and

- Investment holdings.

All these segments will be offered a tailor-made solution through dedicated relationship management, advisory mandates, and tailormade investment solutions.

The Challenges and the Future

Depending on the opening of borders around the world, Mauritius is targeting 650k tourists in the next 12 months, opportunities should arise within the hotel industry, the SMEs, family-owned businesses, and other sectors. This should also create a new perspective for wealth creation, which is expected to positively impact credit risk and redeployment of excess liquidity. This will also create a new perspective for wealth creation, which is expected to positively impact credit risk and redeployment of excess liquidity. The sales teams will be pro-actively looking at all opportunities where ABL will play an important part in contributing to both personal and corporate growth. ABL must be ready to be among the first banks to capture these opportunities through increased presence in the market and building a further relationship with the clients. Lastly, giving access to our banking products & services through a digital platform will contribute to ABL’s competitiveness. All these initiatives will help us achieve our growth targets for 2021-2022.

OUR CORE PILLARS

- Maintain regular presence in the media via recurrent market updates (local and international) and new investment products & solutions.

- Offer financial support to local entrepreneurs and family businesses for their cash flow requirements and payment of their imports.

- Increase our Private Wealth capabilities so as to continuously come up with innovative investment solutions through agreements with reputed brokers, fund managers or private equity funds operating in developed markets worldwide.

Major Business Segment’s Achievements

From July 2020 to June 2021 the Asset under Mandates (“AUM”) increased by more than USD 30M. Average annual fees taken by the Wealth Management Department per mandate is above 0.6% (over and above transaction fees, custody fees and fund retrocession fees). Additionally, Investment solutions have generated circa USD 300,000 of arrangement fees for the year (average ROA of 2.8% per year). At current pace the department generates USD 45,000 on a monthly basis or USD 540,000 per year (MUR 21M+).

Our Strategy and Proposition

For the new financial year 2021-2022, we target to:

- Reinforce the Investment department to better serve targeted clientele → Better salesforce

- Increase the LTV for Lombard financing for clients under all-in mandate → Grow the asset book

- Create a Wealth Management interface available on Internet Banking and mobile app to share department’s investment themes and available investment solutions for clients to transact online worldwide → 24/7 sales

- Collaborate with Structuring department to offer a wider range of investment products to HNWIs → Increase our cross-selling capabilities and accordingly improve bank’s profitability

- Set up jointly with Global Business, on a profit sharing basis, a dedicated offer to small FAs and IFAs (Africa and France) that would cover custody, transaction, research, portfolio mandate and investment solution (structured products) → Additional Business Line

The Challenges and the Future

Low interest rate environment is an opportunity for the Wealth Management department as we offer potential higher return that could attract HNWI and some mass affluent clients. In addition, we can offer to local client’s ability to diversify away from a Mauritian rupee portfolio. Interest rates are likely to steepen in the near future following FED decision to taper later this year. At this stage the increase should not be an issue as yields are expected to remain low. However, we need to ensure that we are offering investment solutions in line with the business and economic cycle to waive any downside risks on the equity market. US growth has likely peaked and Europe should be next on track.

OUR CORE PILLARS

- Maintain regular presence in the media via recurrent market updates (local and international) and new investment products & solutions.

- Maintain a high level of competence on the portfolio management side to retain existing portfolios and improve salesforce capabilities.

- Participate to more roadshows, professional events in Mauritius and in core countries of target.

Major Business Segment’s Achievements

This has been a year unlike any other, a year with unique challenges in both our professional and personal lives. The start of the financial year took place in the shadow of the coronavirus pandemic, and we are grateful for how the team responded and adapted to this unprecedented situation. We went through the deepest recession in post war history and the Mauritian economy was not spared. It is expected to have shrunk by 15% in the last year. With Mauritius being cited as an example in the fight against COVID-19 after the first wave in March 2020, the second wave, a year later, has driven a sizable local outbreak. However, reopening of borders in a phased approach, was welcomed by the hospitality industry after a successful acceleration of the country’s vaccination programme. At AfrAsia Bank, we persevered in our dedication to serve our clients, not limited to the Tourism industry, who turned to us in need. We offered deferred payments and other forbearance options. The outcome of our actions, amidst these extraordinary circumstances, was demonstrated in the 2020 Customer Survey results by IBL. We distinguished ourselves by achieving a higher customer satisfaction index showing that we never lost sight of our purpose: Client service excellence. Given the challenging environment and more cautious risk management, the balance sheet size was forecast to reduce. Thus, although average loans stood at approximately MUR 19bn, down 21%, and with correspondingly lower revenues, the impact was broadly aligned with expectations for the year.

Our Strategy and Proposition

The Corporate Banking division primarily acts as a debt house and originator of assets in foreign currency focused on providing lending solutions ranging from short-term lending, term lending, debt advisory products to corporate syndications. On the domestic front, the division acts as the custodian of the entire client relationship providing a full suite of products across transactional banking, trade finance, debt advisory, lending and forex solutions. Clients range from the Top 100 corporates to parastatals and government bodies. On the International Banking desk our client coverage is niche, selective and driven by known relationships of our banking partners abroad. Although the core markets have been South Africa and India, the division has been successful at diversifying its risks across new markets on the African continent and the emerging markets of Asia.

The Challenges and the Future

As we stand today in July 2021, evidence suggests progress has been made globally to address the impact of COVID and steer life back towards some level of normalcy. Whilst global economic recovery continues there remains a widening gap between advanced economies and many emerging market economies. Closer to home, Mauritius is aiming to welcome 650,000 visitors in the next 12 months, although the tourism industry will have to wait a little longer to fully bounce back. Even more encouraging is the high possibility of Mauritius being delisted from the FATF grey list later on this year, benefiting the global business sector and the country at large from a reputational perspective. We are thus moving in the right direction. However, a truer picture will only be revealed once government-backed support mechanisms are also withdrawn. Certainly, momentum on the international credit markets has gathered pace and, potential for growth in the domestic market is expected to follow. This year we see market opportunities arising from sustainable finance products, which is becoming increasingly important for many of our clients across all businesses locally. AfrAsia Bank showed its firm commitment to a green agenda as it was awarded a line of funding in August 2020 under the SUNREF programme launched by France through the AFD in Mauritius. In an era of ultra-low interest rates for the foreseeable future, interest margins will continue to be squeezed. Focus will be on growing our balance sheet, capturing a higher wallet share across our client base and diversifying our products and services to build more durable sources of revenue.

OUR CORE PILLARS

- Client relationship : We focus on building lasting relationships with our most active clients and helping them structure and execute transactions seamlessly.

- Adaptive & flexible : We partner with our clients by providing them with meaningful advice and helping them navigate this dynamic economic environment, whilst ensuring we exceed their expectations.

- Teamwork : We encourage a culture of teamwork, fostering cooperation and cross selling across our business lines, on a coordinated basis.

Major Business Segment’s Achievements

Corporate Banking- A number of opportunities originated but hampered by tight credit conditions in the prevailing COVID climate.

Global & Private Banking: Continued solid growth in fixed deposits, transactional banking, foreign exchange and global custody.

FI: Good growth in our loan book in the past year.

General: SAREPO successfully hosted webinars on the Mauritius IFC to potential clients.

Our Strategy and Proposition

Corporate Banking: A uniquely Mauritian corporate bank offering competitively priced hard currency loans to SA corporate borrowers.

Global & Private Banking: Reviewing existing client portfolio & identifying cross-selling, opportunities, growing customer base through referrals, streamlining through de-risking. We are still seeing private clients on a one-on-one basis and the uncertainty of the world global economy has created a growth opportunity in the private banking sector.

FI: A Mauritian bank that is competitive in the South African Financial Institution markets landscape.

The Challenges and the Future

Corporate Banking: To pursue selective opportunities, particularly in health and pharmaceuticals sector, in an environment impacted by the economic fallout from the COVID pandemic. Capitalize on SA corporates anticipated growing appetite for international exposure following recent events which have elevated domestic SA risk. Global & Private Banking:

- Target New Startups & Wealth creators – New and upcoming UHNWI & HNWI considering cross border expansion/ business diversification;

- Build on existing customers and referral base - Referrals from existing networks; advantage of current relationships and connections (e.g. IMC’S, Introducers, direct client relations etc.); and

- Target Regional Africa based customers and Expatriates seeking to diversify wealth due to regional country risks.

FI - Increasing product cross sell using the FSCA license

OUR CORE PILLARS

- Corporate Banking: Pursue collaborative lending opportunities with local & international banks.

Global & Private Banking: nurturing existing client relationships and identifying cross-selling opportunities.

FI: Pursue good credits & robust institutions.

- Corporate Banking: Capitalise on SA corporates seeking offshore exposure in light of SA sovereign risk.

Global & Private Banking: continue marketing initiatives such as the webinars platform.

FI: Africa is becoming core with additional business across the continent.

- Corporate Banking: Seek and increase exposure to health & pharmaceutical sector clients in the Covid environment.

Global & Private Banking: seek inter-departmental cross-selling opportunities.

FI: Cross selling treasury products (such as FX lines, money market, etc.) to other areas.

Major Business Segment’s Achievements

Treasury & Markets’ gross operating income remained on target, spearheaded mostly by Trading Income and Net Interest Income and growth on the Custody & Securities Services side. Trading Income remained robust at MUR 945m, with a resilient performance on the FX side of the business despite challenging market environment. The Money Markets/ Fixed Income side of the business was nevertheless impacted by the sharp decrease in interest rates and a lack of secondary market activity. Given a sharp decrease in market interest rates, Net Interest Income from Treasury activities was impacted by lower yields, as has been the case globally. The Balance Sheet nevertheless remains well positioned for any potential uptick in yields on the back of the global economic recovery in the medium term.

The Custody and Securities Services side of the business grew 14% on the back further growth in Assets under Custody (“AUC”) and increased trade activity from this segment. The business remains poised to show further growth with the imminent rollout of the Bank’s new Custody Solution Software.

Our Strategy and Proposition

Below is our Proposition by unit:

- Treasury: To be the most innovative and avant-gardist Treasury on the island;

- Financial Institutions: To have well diversified and high-quality Financial Institutions partners;

- Custody & Securities Services: To be the best Custody Services provider with state-of- the-art infrastructure; and

- Debt Capital Markets (“DCM”): To be the go-to Bank for local DCM Mandates

The four key pillars within the Treasury & Markets cluster are Treasury, Financial Institutions, Custody & Securities Services and Debt Capital Markets. Our goal is to ensure that our client facing and support functions are aligned to consistently provide our clients with best in class services. Treasury & Markets’ prerogative is to provide clients with tailored solutions by reinforcing AfrAsia Bank Limited’s position as the market makers for foreign exchange, interest rate, debt, and other structured derivatives. AfrAsia Bank Limited further consolidates its stance as an innovative Financial Markets service provider catering not only to Mauritian demands but also effectively meeting financial requirements in the regional sphere. Its local expertise, global access and balance sheet scale allow the Bank to provide clients with a range of financial instruments to meet their risk management, investment and trading needs. Managed by a team of professionals with decades of experience, Treasury & Markets is committed to satisfy its clients’ commercial and investment needs.

The Challenges and the Future

The future remains riddled with uncertainty due to the Global Pandemic and the COVID induced recession. There is still significant turmoil in global markets whereby we are still expected to see increased volatility in financial markets for the foreseeable future. The severe contraction of the local economy, especially on the back of the 2nd national lockdown has presented additional challenges for the banking sector. We nevertheless remain optimistic as to the economic recovery on the back of most economies reopening. Given the current landscape, our focus shall be on shoring up risk taking by adopting a Risk Robust approach to Treasury & Markets activities. We nevertheless remain ready to support our stakeholders and will keep abreast of market developments, so as to identify the right opportunities.

OUR CORE PILLARS

- We aim to foster a “Trading Culture” irrespective of asset class, by increasing the number of in-house traders. Up-skilling of our human capital and research is at the core of this strategy, driving economies of scale in the long run.

- A flexible and nimble approach to Risk Management and a constant diversification strategy, enabling the Bank to fully embrace the challenges brought upon by the COVID-19 pandemic.

- The tough economic environment has forced the business to ringfence its core activities and protect stakeholder value across its value chain.

ACM has separated from AfrAsia Bank in February 2021 in response to the regulation requirements from the BOM and the will of its shareholders to restructure its activities. This has been gradually conducted over the past 18 months with the helping hand and support of the AfrAsian Community. AfrAsia Capital Management Ltd is now known as Ekada Capital Ltd (EKADA Capital). This rebranding stems from its shareholders’ ambition to position EKADA Capital as one of the leading independent Wealth Manager in the region. EKADA Capital’s DNA is reflected in its logo, vision, mission and core values, all deeply rooted in its very name, which derives from Sanskrit’s ekhada, meaning “together”. While EKADA Capital now operates as an independent body, it remains a business partner of AfrAsia Bank as it continues to promote the Bank as a privileged custodian and bank partner in Mauritius.

ECONOMIC OUTLOOK

2021, Obstacles Along The Path To Recovery

As the pace of vaccinations accelerated, though uneven globally, the share of people working has been rising. Activity in different sectors has picked up and adapted to pandemic restrictions over recent months. Global growth is expected to accelerate to 5.6% in 2021, following the reopening of major economies such as the United States and China. Central banks have maintained their accommodative stances to support the global recovery as the U.S. Federal Reserve entertained high inflation readings until employment is normalised, the European Central Bank readjusted its inflation target to 2%, allowing for consumer prices to rise when necessary, while the People’s Bank of China has implemented timely cuts in the bank reserve requirement ratio (“RRR”) to support the real economy, particularly small firms. Still, two factors are still unnerving markets; the rise of the delta variant dampening economic outlook and global inflation, which has increased along with the economic recovery

THE MAURITIAN ECONOMY

The Mauritian economy has been severely affected by the pandemic and the government is trying its level best to manage the number of new cases and deaths and to mitigate the economic impact of the crisis. With the closure of the borders, the tourism sector, which normally contributes around 24%

of GDP and 22% of employment, was the most affected, real GDP contracted by 15% in 2020, and the current account deficit widened (-10.1% of GDP in 2020 against -5.7% of GDP in 2019 source: trading economics). This has had a knock-on effect on the economy as a whole.

The pandemic led to a contraction in economic activity across the board

With tourism coming to a standstill in 2020Q2, the tourism receipts collapsed

The budget deficit has also widened due to lower revenues and increased spending to meet various necessities. Inflation remains low, with headline inflation at 1.9% in April 2021. At the same time, the current account deficit has widened to MUR 17.2Bn at the 1st Quarter of 2021 due to lower exports and tourism receipts.

The vaccination programme started in February 2021 and the government expects at least 60% of the population to be vaccinated by October 2021. The Mauritian borders have been partially opened and the full reopening is planned for October.

Furthermore, Mauritius has been placed on the Financial Action Task Force (FATF) in February 2020 due to strategic deficiencies identified by the FATF in its AML/CFT system. In order to graduate from this list, Mauritius was asked by the FATF to implement an action plan, which included, among other things, the implementation of risk-based supervision of the international business sector and designated non-financial businesses and professions (DNFBPs), timely access to basic and beneficial owner information by competent authorities, training of law enforcement agencies to conduct parallel financial investigations, monitoring of the NPO sector and proper implementation of targeted financial sanctions through awareness raising and surveillance.

At its June 2021 Plenary meeting, the FATF decided that Mauritius warranted an on-site visit following the satisfaction expressed by the FATF Executive that all criticisms of the Mauritian financial services sector for deficiencies in its fight against money laundering and terrorist financing have been addressed. The organisation will use its report to initiate the process of formally removing Mauritius from the list. If this is the case, Mauritius could then be considered for removal from the EU’s blacklist.

CHIEF FINANCIAL OFFICER STATEMENT

The Bank sustained through strong waves of interest rate cut all across the world. It was a unified effort that drove the Bank to travel through these testing times with a bottom-line that showed optimal equilibrium between cost and income to sustain itself and a Balance Sheet marked by strong customer confidence and a quest for liquidity.

PERFORMANCE HIGHLIGHTS

| THE GROUP | THE BANK | |||||

| 30 JUNE 2019 | 30 JUNE 2020 | 30 JUNE 2021 | 30 JUNE 2019 | 30 JUNE 2020 | 30 JUNE 2021 | |

|---|---|---|---|---|---|---|

| STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME (MUR'M) |

||||||

| Net interest income, calculated using EIR method | 2,311 | 2,028 | 1,071 | 2,311 | 2,028 | 1,072 |

| Non-interest income | 1,368 | 1,781 | 1,512 | 1,382 | 1,787 | 1,510 |

| Total operating income | 3,679 | 3,809 | 2,583 | 3,693 | 3,815 | 2,582 |

| Total operating expenses | 1,087 | 1,196 | 1,087 | 1,045 | 1,193 | 1,093 |

| Profit after tax after OCI | 1,627 | 1,528 | 929 | 1,579 | 1,502 | 916 |

| STATEMENT OF FINANCIAL POSITION (MUR'M) | ||||||

| Total assets | 141,361 | 160,477 | 190,083 | 139,873 | 160,473 | 190,083 |

| Loans and advances to banks and customers | 28,169 | 28,290 | 25,389 | 28,169 | 28,290 | 25,389 |

| Deposits from banks and customers | 131,033 | 150,922 | 179,197 | 131,208 | 150,947 | 179,211 |

| Total equity (including Class A shares) | 7,701 | 8,651 | 9,057 | 7,716 | 8,641 | 9,047 |

| PERFORMANCE RATIOS (%) | ||||||

| Return on average equity | 26 | 21 | 12 | 25 | 21 | 11 |

| Return on average assets | 1.2 | 1.0 | 0.5 | 1.2 | 1.3 | 0.5 |

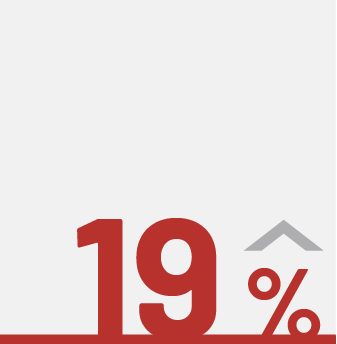

| Loans-to-deposits ratio | 21 | 19 | 14 | 21 | 19 | 14 |

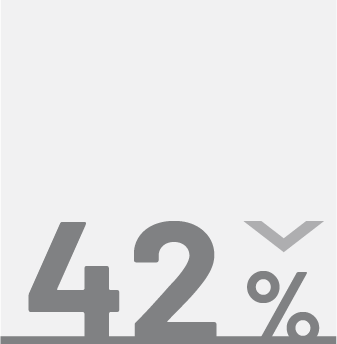

| Cost-to-income ratio | 30 | 31 | 42 | 28 | 31 | 42 |

| CAPITAL MANAGEMENT (%) | ||||||

| Capital adequacy ratio | 15.32 | 15.15 | 16.18 | 15.85 | 15.15 | 16.18 |

PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME REVIEW

NET INTEREST INCOME

AfrAsia Bank reported a net interest income (“NII”) of MUR 1.1bn, 47% lower than in the prior year. The obvious driver being the ongoing pandemic and its effects that created market volatility, rapid liquidity shifts, unexpected demand drops, erosion of market value on both local and global scale and lower spreads as central banks around the world cut interest rates. There was also an accurate contraction in economic growth in the wake of the pandemic and the Government’s ample fiscal policies which deteriorated the country’s fiscal metrics. These combined effects also overwhelm existing models for Expected Credit Losses (“ECL”) as more resources are required to measure the variations in market conditions.

In terms of segmental split, a shift is noted year-on-year as we note a 72% contribution from Segment A as compared to a 40% contribution last year.

FINANCIAL POSITION REVIEW

TOTAL ASSETS

The Bank’s asset base grew by 18% (MUR 29.6bn) and reached MUR 190.1bn by end of this year under review. This growth was primarily in cash and cash equivalents and due from banks, while investment securities and loans and advances both noted a fall of 7% and 10% respectively whereas other assets were relatively stable when compared to last FY.

From an asset distribution viewpoint, it is noted that around 61% of total assets was occupied by cash and cash equivalents and due from banks which reflects the risk appetite of the Bank. Investment securities experienced a 7% drop year-on-year, the preponderance residing mainly in debt instruments measured at amortised cost (88%) and the residual 12% residing mainly financial assets held for trading measured at fair value through profit or loss. Other assets, with its foremost component being mandatory balances with the Central Bank (MUR 2.3bn), did not experience major change. Furthermore, the proportion of the Bank’s total assets to Segment B represented 62% in 2021 which represents a slight decrease when compared to 65% in 2020.

An industry breakdown of the Bank’s financial assets, without taking account of any collateral held or other credit enhancements, is as follows:

| GROSS MAXIMUM EXPOSURE | ||||

|---|---|---|---|---|

| Sectors – MUR’m | 2019 | 2020 | 2021 | |

| Total | Total | Total | ||

| Agriculture | 510 | 1,279 | 979 | |

| Construction, infrastructure and real estate | 1,119 | 1,980 | 1,850 | |

| Financial and business services | 121,014 | 100,869 | 136,142 | |

| Government and parastatal bodies | 479 | 35,022 | 32,201 | |

| Information, communication and technology | 17 | 1,101 | 1,275 | |

| Manufacturing | 2,726 | 5,867 | 3,934 | |

| Personal | 1,912 | 2,374 | 2,785 | |

| Tourism | 3,166 | 4,528 | 4,919 | |

| Traders | 1,551 | 4,453 | 3,795 | |

| Others | 8,700 | 4,598 | 4,174 | |

| Total | 141,194 | 162,071 | 192,054 | |